Unlocking the Potential of Community Finance in Small and Midsized Cities

Written by Bernita Johnson-Gabriel

Small and Midsized Cities (SMCs) are the backbone of our nation's economic and social fabric. Home to over a quarter of the U.S. population, SMCs (with populations ranging from 30,000 to 500,000) are uniquely positioned to deliver equitable and vibrant communities.

New Growth Innovation Network (NGIN) collaborated with Black Onyx Management to explore the untapped potential of impact investing to drive inclusive growth and resilience in SMCs. Together, they undertook comprehensive analytics on the crucial role of Community Financial Institutions.

Community Finance Institutions (CFIs), which include Community Foundations, Community Development Entities, and Community Development Financial Institutions, are at the forefront of the impact investing movement. By channeling capital into projects that generate both financial returns and positive social outcomes, CFIs drive economic growth, reduce inequality, and foster sustainable development.

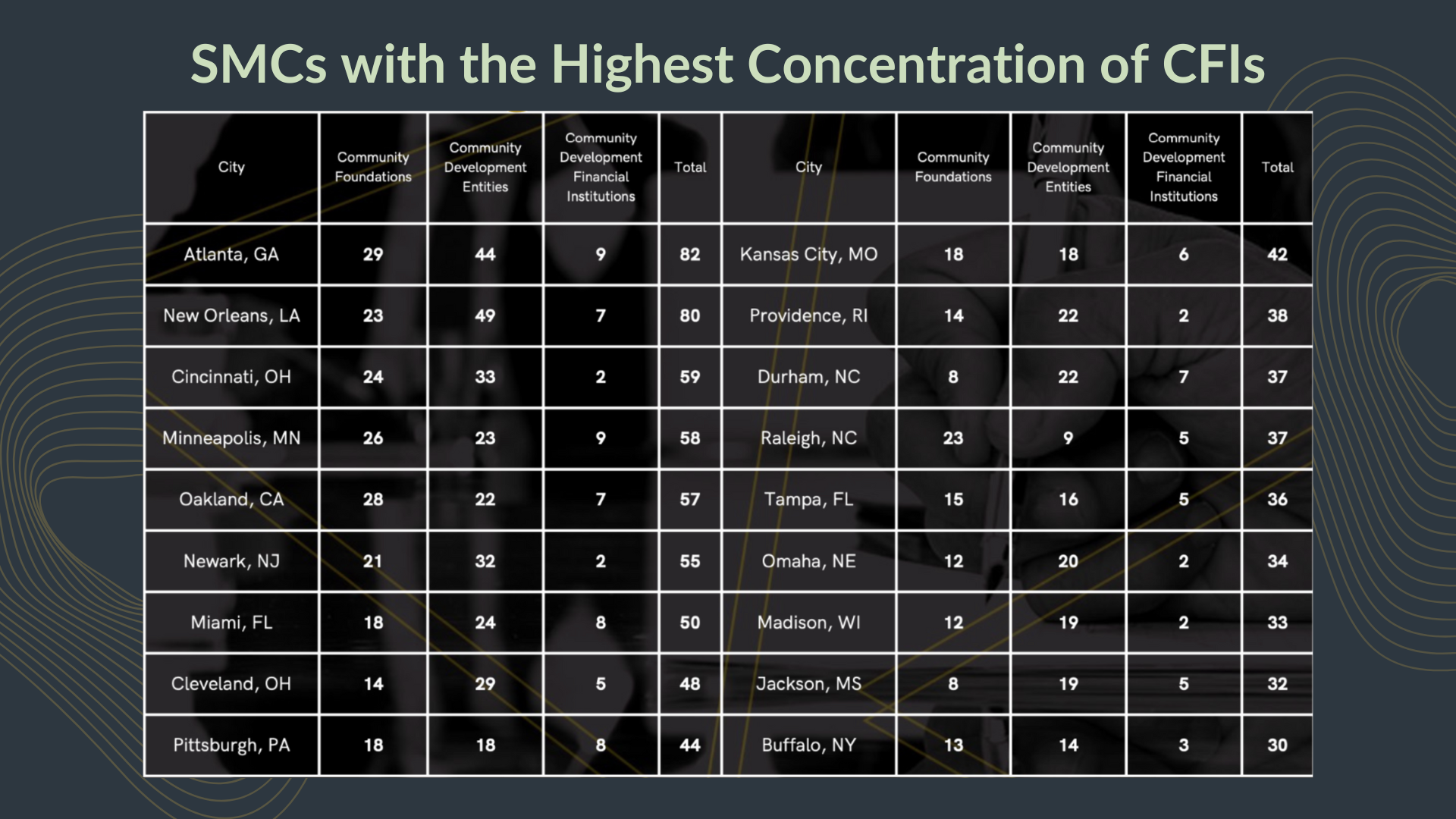

Black Onyx's research found that Small and Midsized Cities host an average of 5.19 Community Finance Institutions (CFIs). However, there is significant variability among the 700+ SMCs, with some having no CFIs and one having as many as 82 CFIs.

Interestingly, Black Onyx also discovered that capital flow varies greatly and is not fully correlated with the presence of community development institutions. This finding raises questions about the difference between general investment and intentional community investment. Additionally, among the cities with the largest number of community development institutions, there are larger-than-average Black populations, potentially indicating a relationship between historical funding gaps and an increased reliance on community funds.

Case Study: Cleveland, OH

Cleveland exemplifies the positive impact of strong community development organizations. With 48 such entities, the city demonstrates how coalition building can facilitate effective capital flow and community development. By leveraging local strengths and fostering regional partnerships, Cleveland creates a supportive environment for sustainable growth through impact investing.

“One of the strengths of small and midsize cities is their deep community connections. By forming local or regional coalitions, we can leverage these connections to disperse large funds effectively and maintain the unique identity of each city.”

— NGIN’s Small and Midsize City Report: An Inclusive Capital Comprehensive Strategy and Framework

Looking Ahead: Upcoming Research

Building on our initial findings, NGIN and Black Onyx Management are delving deeper into the financial dynamics of ten SMCs. This phase will identify key players, financial trends, and regional investment fund structures that could enhance capital access and bolster community development.

We aim to test the hypothesis that a higher number of CFIs, such as those in Atlanta and New Orleans, correlates with increased capital flow to mixed-use development projects and a higher volume of deals. We’ll examine the characteristics of SMCs that contribute to successful capital deployment, with the ultimate goal of developing a regional impact investing approach.

In conclusion, we believe impact investing holds the key to unlocking the potential of Small and Midsized Cities. Would you like to share your thoughts? Join us on this journey and stay connected through our newsletter for the latest updates on this research.